I Refuse to Sacrifice My Dream for My Stepdaughter’s ’’Stupid Hobby’’ / Bright Side

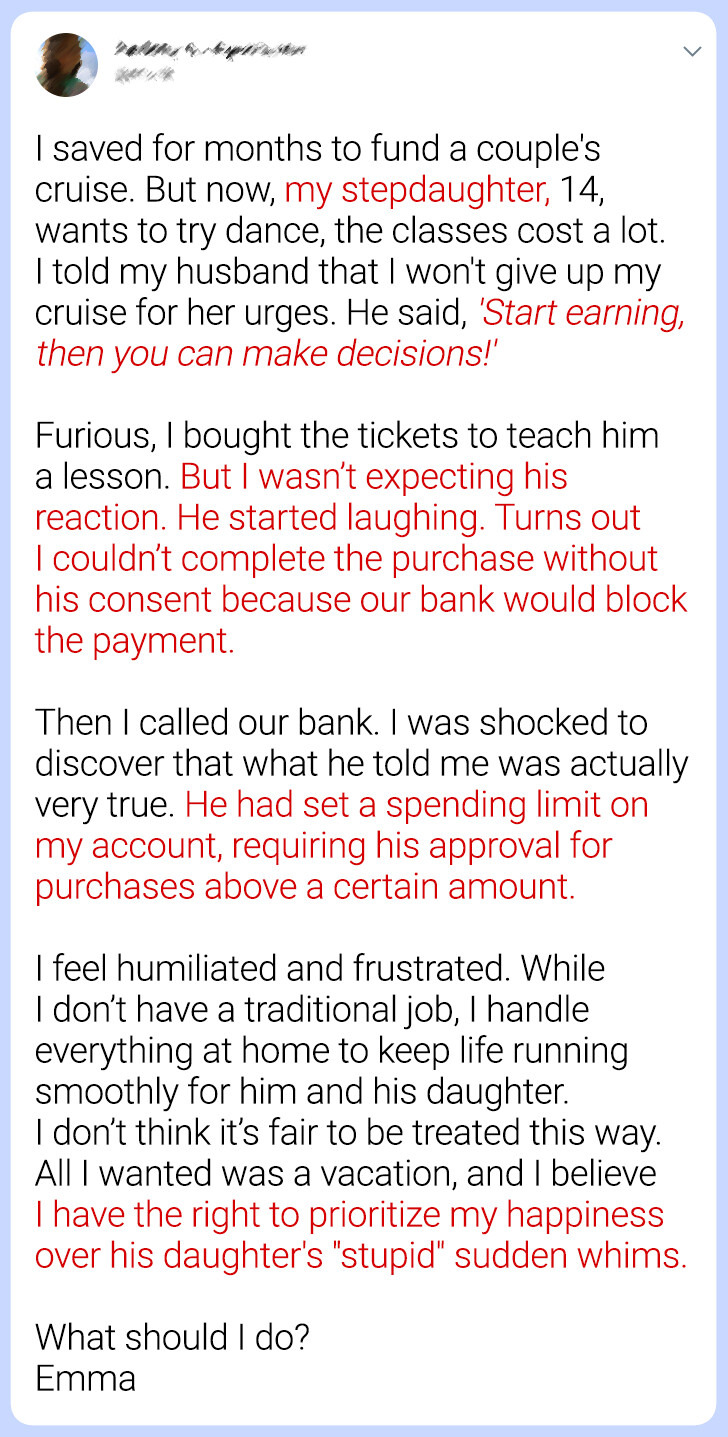

Money problems can strain family relationships, and Emma’s situation was no different. She had been saving for a dream cruise with her husband, but unexpectedly, he redirected their savings toward his daughter’s new interest—something Emma hadn’t agreed to. This disagreement not only derailed their plans but also uncovered troubling truths about their finances. Distraught and unsure of her next steps, Emma turned to us for advice.

This is Emma’s letter:

Hi Emma! Thank you for having the courage to share your story with us. We’ve prepared some guidance to support you as you work through this delicate situation.

Set financial boundaries and discuss transparency.

Since your husband has set a spending limit on your account without prior discussion, address this directly in a calm but firm conversation. Request full disclosure of financial decisions involving joint accounts.

Emphasize that while he earns the money, you contribute significantly by managing the household, and you deserve a say in spending decisions.

Suggest implementing a mutually agreed-upon budget where both of you have individual discretionary funds to use as you see fit.

Reevaluate household roles and contributions.

Point out that managing the home and caring for his daughter are significant contributions that allow him to focus on his job. Propose redefining your financial dynamics to reflect the value of your unpaid labor.

For instance, request a personal account with regular deposits or a shared fund specifically for your needs and goals.

This would empower you to make financial decisions independently, including saving for personal goals like vacations.

Find a compromise on the dance classes and vacation.

Instead of framing the situation as a choice between her dance classes and your vacation, propose a compromise. For example, suggest exploring more affordable or trial dance options while saving for the cruise.

Highlight that this approach addresses both the child’s interest and your dream without undermining either. Frame it as a team effort to balance family needs and personal aspirations.

Pursue financial independence and leverage it.

Consider starting a part-time job, freelancing, or monetizing a hobby to create your own income stream. This would not only help you regain financial control but also demonstrate your capability to contribute directly to family finances.

Once you have your own income, allocate a portion for personal goals like vacations, and ensure future decisions about such matters are entirely your own.

Speaking of unexpected discoveries, Serena uncovered a shocking secret about her daughter—one that her husband had been hiding from her as well. Read her story here.